Don't miss our offers- up to 50% OFF!

Brand New Collection

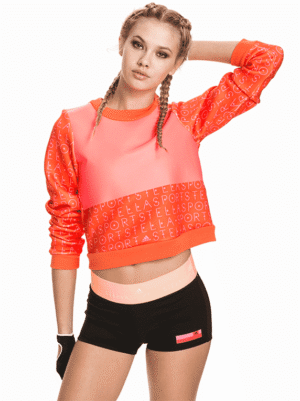

We believe fashion isn’t just about what you wear; it’s about how you feel. That’s why we’ve curated the latest in clothing, footwear, and accessories for men and women, designed to empower every move, moment, and mood.

Top Brands

High Quality

Free Delivery

Secure Payment

100% Secure Payment

14-Day Return

If products have any issues

24/7 Support

Dedicated support

Free Delivery

For all orders over ₹1000

Check out latest products

New Arrivals

-

SALE

Snapback Cap

1,200.00₹Original price was: 1,200.00₹.1,000.00₹Current price is: 1,000.00₹.Rated 4.00 out of 5 -

Gray Shoes

2,500.00₹Rated 3.00 out of 5 -

SALE

Black T-shirt

300.00₹Original price was: 300.00₹.250.00₹Current price is: 250.00₹.Rated 5.00 out of 5 -

SALE

Retro Sunglasses

150.00₹Original price was: 150.00₹.120.00₹Current price is: 120.00₹.

461 articles

Jackets

289 articles

Sweaters

345 articles

Accessories

Check out popular products

Popular Products

-

Armor Twist

499.00₹Rated 5.00 out of 5 -

Dark Jacket

4,599.00₹Rated 5.00 out of 5 -

SALE

Flowy Blouse

3,999.00₹Original price was: 3,999.00₹.3,599.00₹Current price is: 3,599.00₹.Rated 5.00 out of 5 -

SALE

Casual Dress

4,999.00₹Original price was: 4,999.00₹.4,599.00₹Current price is: 4,599.00₹.Rated 5.00 out of 5

New Cloth Technologies

At Rudraxee, we don’t just follow fashion we hand-pick the best innovations to bring you products that are smarter, more comfortable, and designed to perform in your everyday life.

Every piece in our collection is carefully chosen for quality, functionality, and style, so you can shop with confidence and wear with ease.

SANJEEV KUMAR, CEO

Check out popular products

Popular Products

-

SALE

Black T-shirt

300.00₹Original price was: 300.00₹.250.00₹Current price is: 250.00₹.Rated 5.00 out of 5 -

SALE

Quartz Watch

4,599.00₹Original price was: 4,599.00₹.4,399.00₹Current price is: 4,399.00₹.Rated 5.00 out of 5 -

SALE

Slim Sweater

4,999.00₹Original price was: 4,999.00₹.4,599.00₹Current price is: 4,599.00₹.Rated 5.00 out of 5

₹1000 ONLY!

Final Sale

Don’t miss your last opportunity to grab our best at unbeatable prices.

Hurry! These pieces won’t last long; once they’re gone, they’re gone for good.

Newsletter Updates

Subscribe to receive emails on new product arrivals & special offers